An Explanation

About the R&D Tax Credit

The R&D tax credit has been one of the most valuable tax breaks leveraged by American companies for the past several decades. It was founded in 1981 to increase investment in U.S.-based innovation, and now provides billions of dollars in tax savings annually to companies across the country. Companies claiming the R&D tax credit continue to benefit from the “normal” tax deduction for their R&D expenses.

R&D Tax Credit Key Facts

- The R&D tax credit is available to small companies as well as large ones. Many small companies do not realize that this tax credit could save them a significant amount of money on taxes each year.

- The federal tax credit generally amounts to 5-10% of R&D expenses.

- Many states offer additional R&D tax credits, these range from 3-15% of R&D expenses.

- The R&D tax credit can be claimed for the current year, and for up to 3 years in the past.

- It can reduce payroll taxes for certain pre-revenue start-up companies.

- This tax credit is not just for technology and manufacturing companies. In today’s world, companies in a wide range of industries are eligible

In order to be eligible for the R&D tax credit, a company must spend money in an endeavor to make a new or improved “something”: a physical product, software, a production process, a specialized technique, or a design (including building systems or structure designs). The following four expense categories can be included in the R&D tax credit calculation:

- Wages paid to U.S. employees involved in design, prototyping, testing, etc.

- Payments to U.S. contractors or vendors providing R&D services

- Materials used during these activities

- Payments for cloud-based dev environments or cloud-computing development resources

How much could the R&D tax credit save you?

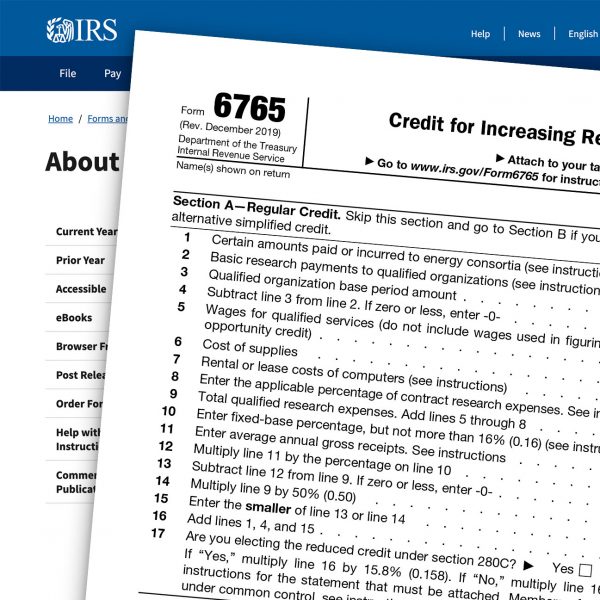

How can companies claim their R&D tax credit?

This process begins by gathering R&D expense information and records that support the R&D activities that have taken place. The tax credit amount is then calculated, and the credit itself is claimed via the company’s tax return. After the credit is claimed, records and documentation are gathered to support the tax credit. This is where Firestone comes in — we specialize in partnering with companies to calculate, claim, and support federal and state R&D tax credits. After one short introductory conversation, we will have a good idea of whether your business could benefit from the R&D tax credit. If your business is eligible, we are committed to helping you claim the maximum amount that you deserve.

R&D Tax Credits by Industry

There is no requirement that companies be part of specific industries to claim the R&D tax credit — it is available to any company regardless of industry that performs qualified activities. The following industries and activities are likely to be eligible.

Software & Technology

Development of software, apps, data handling, memory optimization, processing engines, algorithms, APIs, database technologies, firmware, robotics, new technologies, automated systems, robotics, etc.

Manufacturing

Design of new or improved products, custom products, tools, molds, jigs, fixtures, etc. Development or optimization of CNC programs and equipment operations and toolpaths. Developing new manufacturing processes or capabilities; improving existing manufacturing lines or processes.

Precision Machining

Design of new or improved parts, custom parts, fixtures, jigs. Development or optimization of CNC programs and equipment operations and toolpaths. Development of new machining capabilities or improved processes.

Engineering

Creating HVAC, mechanical, structural, civil, environmental or other designs. Product development, 3D modeling, testing, etc.

Electronics Design & Production

Design of printed circuit boards and integrated circuits, developing circuit board production process (pick & place, through hole, etc.), first article runs, development of mechanical and case components for electronics, etc.

Foundries & Molding

Architectural

Developing energy-efficient features, schematic designs, technical building systems design, building envelope design, etc.

Construction

Building systems design, structural engineering, site engineering, structural and miscellaneous steel detailing and fabrication, design-build projects, etc.

Life Sciences

Formulations development, pharmaceuticals development, development of seed varieties, coatings, treatments, etc.

Food & Beverage

Formulation and recipe development, nutrition profile development, shelf-life and stability testing, production process development, etc.

Retail & Distribution

Financial

Development of client portals, quote-generation engines, servicing and delivery applications, and more in the insurance, banking, investing, and other financial areas.

Service Providers

Development of client portals, quote-generation engines, servicing and delivery applications, and more in the insurance, banking, investing, and other financial areas.

Miscellaneous