R&D Tax credits made simple

This valuable tax credit is not just for technology companies and manufacturers! It provides cash to companies in numerous industries each year.

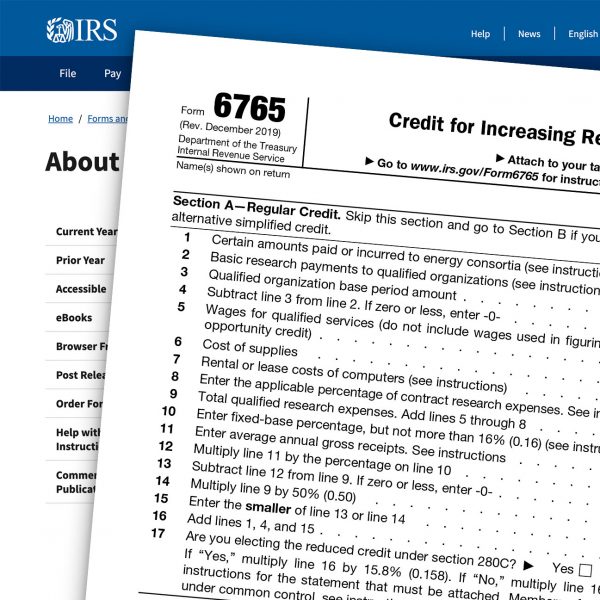

What is the R&D Credit?

The Research and Development (R&D) tax credit is the largest tax break available to many American businesses. Its purpose is to incentivize innovation in the U.S.; it rewards companies with a tax credit based on their R&D expenses.

The federal R&D tax credit provides average tax savings of 5% to 10% of R&D expenses. Many states offer state R&D tax credits of varying sizes — businesses in certain states can receive tax credits totaling 20% of their R&D expenses.

Companies can claim the R&D tax credit for the current year and for the past two or three years. This tax credit is a powerful tool for businesses looking to reduce their tax liability, lower their effective tax rate and preserve cash.

Who Can Benefit?

This tax credit is available to small and large companies in a wide variety of industries. The following expense types are eligible for the R&D tax credit:

- Wages of U.S. employees involved in design, development, testing, etc.

- Payments to U.S. vendors involved in these activities

- Materials used during these activities

- Payments to lease cloud-based software development environments

Any company that creates or seeks to create designs or technology, improve their legacy products, develop new products, or develop software tools for use in their business could benefit if they spent money in these four areas. Many companies are eligible merely through their efforts to stay competitive. Unfortunately, many of these businesses fail to take advantage of this lucrative tax benefit.

How can Firestone Help?

We specialize in partnering with businesses and their tax professionals to uncover, calculate and support available R&D tax credits. After one short introductory conversation, we will have a good idea of whether your business could benefit from the R&D tax credit. We are committed to helping you claim the maximum amount that you deserve.

How much could the R&D tax credit save you?